Calculation of the cost of a patent for individual entrepreneurs by region and type of activity

Patent calculator for 2022 for IP

The patent system of taxation differs from other regimes in that the calculation of the tax takes into account not the real, but the potential income of individual entrepreneurs.

For example, the regional authorities of one region may establish that the annual taxable income of a hairdresser is 350,000 rubles, and in another subject of the Russian Federation this value is 900,000 rubles. As a result, the cost of a patent for one type of activity, but in different Russian regions, may differ by several times.

In addition, municipalities with different values of potential income are distinguished on the territory of the region itself. Because of this, a patent in a regional center or a large city can cost more than in a small town.

With this in mind, an independent calculation of the cost of a patent, and hence the tax burden, is quite complicated. Therefore, for individual entrepreneurs who want to know in advance how much they will have to pay, the Federal Tax Service has developed a special patent calculator.

What data should be collected before the calculation

Before calculating a patent, collect the following data:

- the year in which the patent will be valid;

- the day of the beginning and end of the patent, taking into account the fact that this period is from 1 to 12 months, including incomplete ones, during the calendar year;

- UFNS, that is, a subject of the Russian Federation;

- the municipality in which the IP will conduct business;

- type of activity established by the regional law on PSN.

Additionally, you may need a physical indicator for some business areas:

- the number of employees in patent activities, taking into account the limit of 15 people;

- carrying capacity or number of vehicles;

- area or number of real estate objects, etc.

Examples of calculating the cost of a patent on the FTS calculator

We will show with concrete examples how to calculate a patent on the online calculator of the Federal Tax Service.

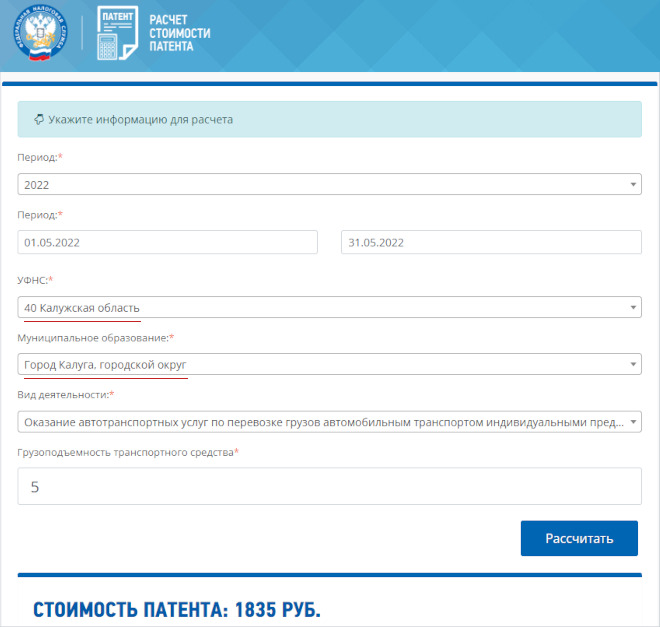

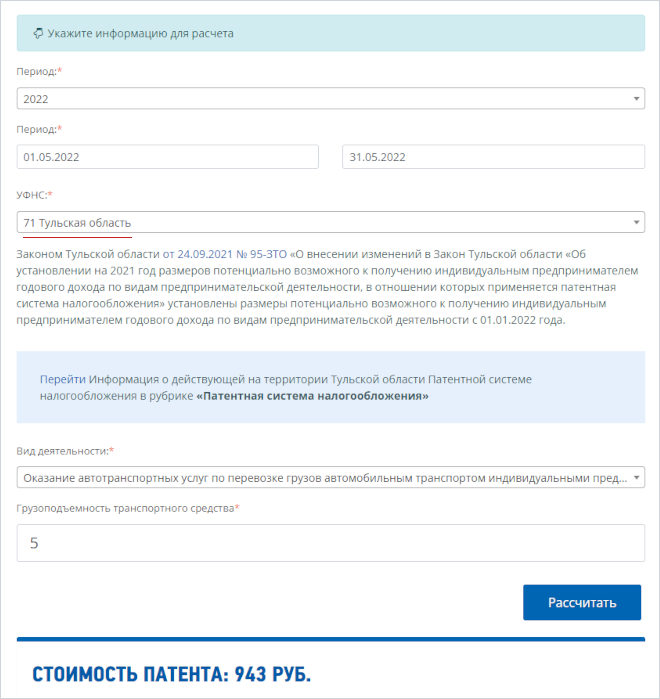

Example 1: an individual entrepreneur without employees plans to carry out cargo transportation in his own car with a carrying capacity of 5 tons. The individual entrepreneur lives on the border of the Kaluga and Tula regions, so he wants to compare the cost of a patent in both regions. For example, let's calculate the tax for May 2022.

Step by step, enter the required data and click the Calculate button.

We get that for 31 days of validity of the patent issued for Kaluga, it will be necessary to pay 1,835 rubles. If a patent is issued in the Tula region, then its cost is lower – 943 rubles.

It would seem obvious that it is more profitable to obtain a patent in the Tula region, because its cost is almost 2 times less.

However, the FTS patent calculator does not take into account that the tax can be reduced due to insurance premiums that the individual entrepreneur pays for himself and his employees.In 2022, the minimum amount of contributions for oneself is 43,211 rubles.

The cost of a patent for the whole of 2022 in Kaluga is 21,600 rubles, and in the Tula region – 11,100 rubles. In both cases, this amount is less than the insurance premiums that the individual entrepreneur transfers for himself. Given that this entrepreneur has no employees, the SIT tax is reduced without restrictions. This means you don't have to pay for a patent.

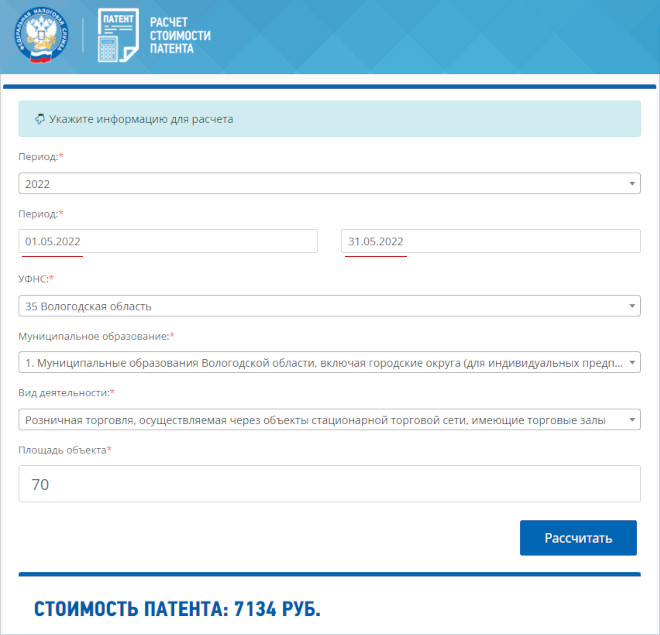

Example 2: An individual entrepreneur with employees opens a retail store in Vologda with an area of 70 sq. meters. Let's calculate the patent:

- for 31 days – 7,134 rubles;

- for the whole of 2022 – 84,000 rubles.

Since the entrepreneur has employees, he can reduce the tax on the amount of the listed insurance premiums, but with a limit of 50%. This means that the cost of a patent for it will be 42,000 rubles for the full year 2022.

For more complex cases of calculating a patent, for example, for several types of activities or in different regions, we recommend contacting the Federal Tax Service. And for our users, we can offer free tax advice on calculating the cost of a patent.

Free tax advice

Thank you!

Your application has been successfully sent. We will contact you shortly.

- LLC registration

- Registration of an LLC in 2022 Full instructions for registering an LLCRegistration of an LLC onlineResponsibility of the founders of an LLC Sample documents Documents for registering an LLCForm R11001Charter of an LLCConstituent documentsDecision of the sole founderMinutes of the meeting of foundersAgreement on the establishment of an LLC OKVED codes All about OKVEDCollection of OKVED codes by type of businessRead all articles

- Help Consultation on LLC registrationConsultation on the selection of OKVED codes

- Free LLC registration service Ready documents in 10 min. Without special knowledge Without errors and double-checking Prepare documents

- IP registration in 2022 Complete instructions for registering an IP IP registration online IP address IP name Sample documents Documents for IP registration Form R21001 OKVED codes Everything about OKVEDCollections of OKVED codes by type of businessRead all articles

- Help Consultation on registration of IPConsultation on the selection of OKVED codes Services Registration of IP on a turnkey basis

- Free IP registration service Ready documents in 10 minutes. Without special knowledge Without errors and double-checking Prepare documents

- Changes in LLC Form Р13014Change of director of LLCChange of legal addressAddition of OKVED codes for LLCChange of charterIncrease of authorized capitalLiquidation of LLC Changes in IP Form Р24001Addition of OKVED for IPChange of IP registrationHow IP to become self-employedClosing IP

- Services Changes of IP on a turnkey basisChanges of LLC on a turnkey basis

- Making changes to LLC in Moscow Change of name Change of legal address Change of CEO Change of participants Change of authorized capital Change of OKVED codes Order a service

- Account for IP Do I need a current account for IPUsing a personal account instead of a settlement accountHow to open a current accountIn which bank is it better to open a current account for IPHow profitable to withdraw cash from an IP account current account in Sberbank Alfa-bank for legal entities

- Help Calculator

- RKO calculator Compare tariffs with each other Filters for business tasks Only current tariffs Only verified banks Open calculator

- OSNO The main system of taxation of the STS STS income STS income minus expensesTypes of activities of individual entrepreneurs on the simplified tax systemTransition to the simplified tax system PSN Patent taxation systemTypes of activities of individual entrepreneurs on a patentSample application for a patent Self-employed Tax on professional incomeTypes of activities for self-employedCan an individual entrepreneur be self-employedRead all articles

- Tax calendar 2021 LLC taxes IP taxes IP contributions IP fees How to choose a taxation system IP tax holidays Tax calculators USNK calculator UTII calculator PSNK calculator VAT calculator

- Free consultation on taxation Selection of the tax regime Drawing up a payment plan Disclosure of controversial issues Leave a request

- Accounting for individual entrepreneurs independentlyAccounting for LLCs independentlyReporting for employeesZero reporting UTII declaration Reporting on the simplified tax system Declaration of the simplified taxation systemReports of an individual entrepreneur on the simplified tax system with employeesReports of an individual entrepreneur on the simplified tax system without employees

- Help Free accounting services 1СAccounting audit of a business

- Service for preparing USN / UTII declarations Calculation of payments for USN / UTII Automatic filling Actual forms Prepare a declaration

- Registration of LLC and IPDeclaration of USN / UTIIIssue an invoice onlineSelection of OKVED codesRKO tariff calculatorSearch on the basis of the Unified State Register of Legal Entities / EGRIPInsurance premium calculatorPartners' offers

- Tax calculators VAT calculatorUSNK calculatorUTII calculatorPSN calculator

- Business Registration

- Business Books Cafe/Bar/PizzeriaBeauty SalonRetail StoreWholesaleLegal ServicesOnline Store

- A series of books Start your own business About popular types of business Details about registration All the features and chips Download books for free